Our website is not supported on this browser

The browser you are using (Internet Explorer) cannot display our content.

Please come back on a more recent browser to have the best experience possible

In the article Risk Management Process: 4 Essential Steps, we looked at the risk management process and how to identify, assess and treat project risks. Despite the implementation of mitigation or avoidance action plans, the adverse effects of some risks do occur, and the project must be able to cope with them. Therefore, the contingency reserve is the budget to cover the effects of these risks.

The contingency reserve is a budgetary envelope in addition to the project budget (which is the sum of the activity costs without any risk impact). This envelope is calculated based on the results of the risk analysis. It allows financial impacts to be covered in case previously identified risks occur. In that case, part of the reserve is added to the project budget.

Examples

The contingency reserve is exclusively allocated to risks and is often managed separately from the rest of the project budget, with specific indicators and steering committees.

However, the reserve is not intended to finance treatment plans for risk response strategies (such as impact reduction, probability reduction, transfer to a third party, etc.). These treatment plans are part of the project budget.

In some organizations, the reserve also covers uncertain and unidentifiable events. In this case, part of the contingency reserve is determined based on feedback from similar projects – for example, a percentage of the project budget.

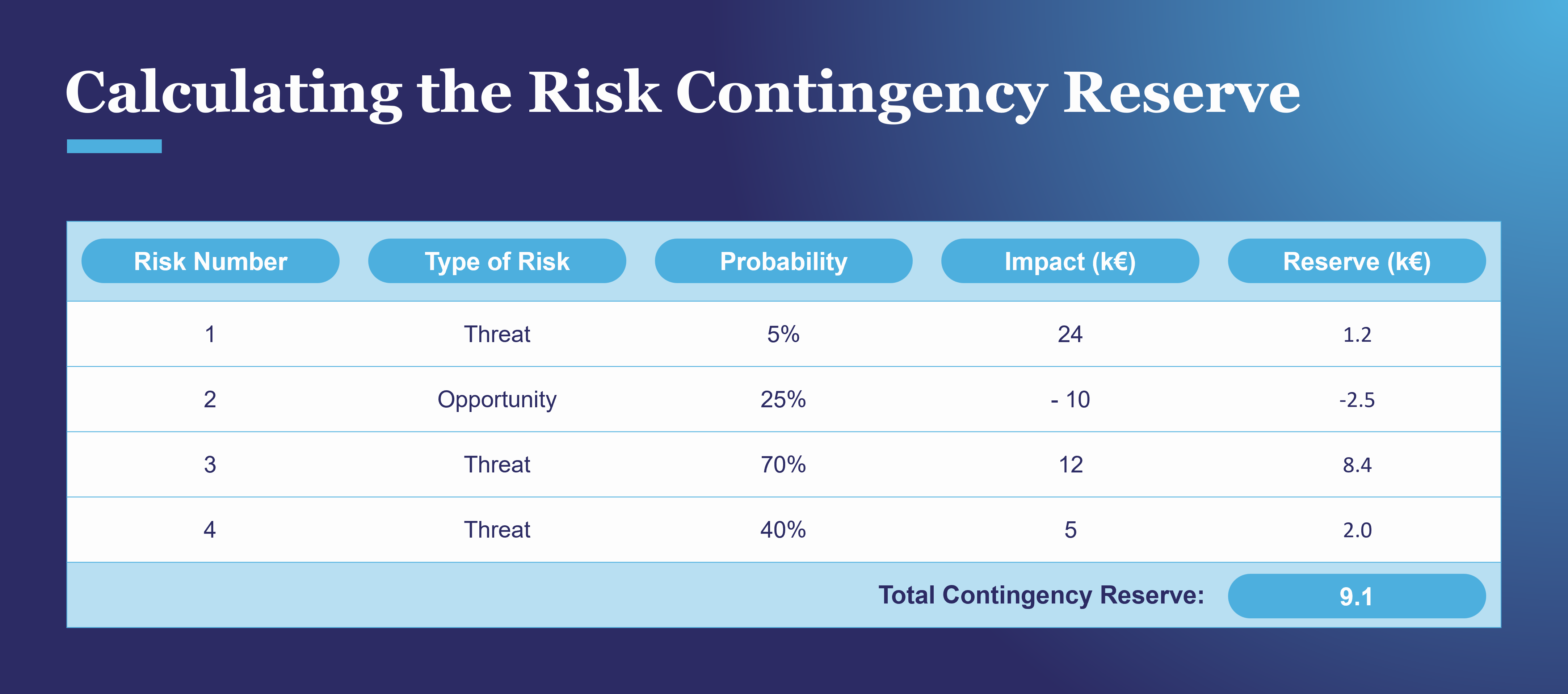

The calculation of the reserve is done in two steps:

For each risk, the objective is to define a value for its probability (as a %) and its impact (in monetary units). By convention, the impact of threats can have a positive or negative value and the impact of opportunities have the opposite value. In our example, we consider the impact of threats to have a positive value (for example 25 k€) and the impact of opportunities to have a negative value (for example -10 k€).

Risk probabilities and impacts should be as factual as possible and generally result from:

Example of probability: the failure rate of a machine is calculated according to the reliability of its components.

Example of probability: the percentage of hard rocks discovered over an entire area whose geological structure has been partially studied.

Example of impact: additional cost being observed in the realization of a part family over several years.

Example of impact: a scoring grid that gives impacts based on probability.

This list is not exhaustive of other methods or sources that can be used depending on the sector, project, or company.

This step can only be conducted after the probability and impact of each risk have been evaluated. The global reserve is the difference between the reserves for threats (positive values) and those for opportunities (negative values).

There are two main calculation methods.

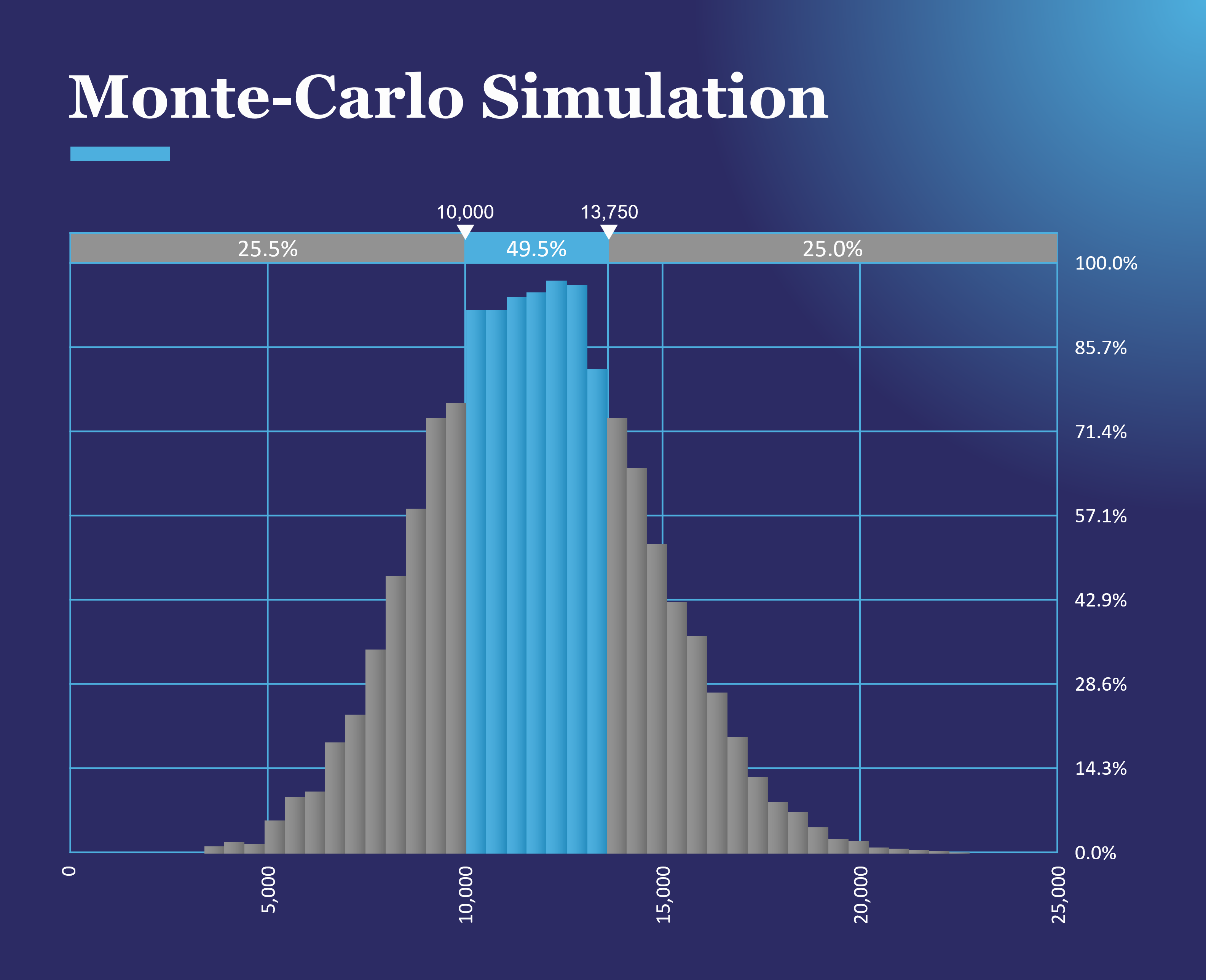

The Monte Carlo simulation consists of applying a probability distribution to each risk (normal law, discrete law, triangular law, etc.) which replaces the single value defined in the deterministic method. It then calculates and recalculates these results (e.g., 5,000 or 10,000 times) with random values being drawn, following the probability distribution of each risk.

This method allows for uncertainties to be considered, which is not the case with the deterministic method. It presents a range of possible outcomes and their probabilities of occurrence. It also reveals extreme possibilities.

The Monte Carlo simulation is interesting when the precise impact of a risk is not known. In this case, the impact characterization is done through a range of values rather than through a single value as in the deterministic method.

Example: The result of this simulation shows us that there is a 75% chance that the reserve will be less than €13,750 and there is only a 25% chance that the reserve will be less than €10,000. Thus, a reserve of €13,750 would have a 75% chance of being sufficient.

Planning the reserve consumption can be done linearly, according to the volume of global project expenses, according to the forecasted occurrence of main risks, etc. It should also be noted that the contingency reserve’s consumption does not always correspond when a risk occurs, but it can be done as the consequences of the risk occur.

The reserve does not cover every impact of each risk. Therefore, it is essential to reassess the reserve in the event of risks with significant impacts and to define reassessment periods. Depending on the organization, specific risk-related committees can be organized. The same indicators as used for budget management can be used for contingency reserves as well.

The contingency reserve is essential to manage the project budget. It justifies the need for a specific budget to deal with the consequences of risks. Thus, the organization is more reactive when risks occur.

The contingency reserve is also an interesting lever to mobilize project members for risk management. It is a tool to communicate about the stability of the project and its results, underlining the importance of risk management.

At MIGSO-PCUBED, our experience shows that effective implementation and management of the contingency reserve is important to improve the predictability and success of project outcomes. This experience comes after many years of supporting our clients across many industries to manage their risks.

Additionally, several tools exist on the market: Palisade, @Risk, Intaver, RiskyProject, Primavera Risk Analysis, etc. MIGSO-PCUBED will be able to advise you on the choice and implementation of tools dedicated to the management of the reserve.

Finally, we work as your project management partner, ready to help you improve your risk management capabilities in a way that makes sense for your organization.

This article was originally written in French by Marie BELGODERE, Xavier BELLIOT, Jérémie CLAUSTRE, Maria CORREAS QUIJANO, Alioune DIALLO, Emmanuel LATGE, Jessy MIGNOT, Pierre PETILLON, Chris WAMAL.

You might also like:

Loved what you just read?

Let's stay in touch.

No spam, only great things to read in our newsletter.

We combine our expertise with a fine knowledge of the industry to deliver high-value project management services.

MIGSO-PCUBED is part of the ALTEN group.

Find us around the world

Australia – Canada – France – Germany – Italy – Mexico – Portugal – Romania – South East Asia – Spain – Switzerland – United Kingdom – United States

© 2024 MIGSO-PCUBED. All rights reserved | Legal information | Privacy Policy | Cookie Settings | Intranet

Choose your language

Our website is not supported on this browser

The browser you are using (Internet Explorer) cannot display our content.

Please come back on a more recent browser to have the best experience possible