Our website is not supported on this browser

The browser you are using (Internet Explorer) cannot display our content.

Please come back on a more recent browser to have the best experience possible

In February of 2023, we formed a new partnership with a regional financial institution, Bank of Guam, to deliver Project Management as a Service (PMaaS). They sought to evaluate, select, and implement a new Project/Program Management service provider to support their PMO transformation. The Bank also wanted to more efficiently and effectively source project management-related roles and capabilities in support of the company’s overall portfolio objectives at a predictable and competitive cost.

Strategically, Bank of Guam decided to use a managed service partner to bring in expertise in an area of the organization in which they were less specialized. This would help them optimize performance and allow their employees to focus more on bank products and services, instead of on project management.

With the Bank’s large portfolio of growing size and complexity, they needed to ensure the new PMO could handle the flux of new projects with the ability to scale as needed. Project management processes had steadily matured over the last five years and were driving improved performance, but the Bank wanted to further accelerate transformation with an experienced provider who could help optimize their processes and capabilities.

Bank of Guam and MP have proved to be great partners for many reasons. First and foremost, the two organizations made sure that sufficient time was dedicated to aligning on strategy and values. The Bank was able to clearly articulate their wants and needs from the beginning, which helped both organizations agree on the conditions for success.

We cannot stress enough the importance of clients who seek providers with an open mind to the solutions that will be recommended. Bank of Guam’s stakeholders came with positive attitudes and a genuine willingness to change. Often, executives will bring in consultants to drive change, improvements, and other analyses. However, the organization’s employees are not always ready to adopt those changes.

In this case, however, everyone we talked to was excited to learn from us and happy to hear our suggestions for improvement. Moreover, we found that many leaders in the organization deeply believed in the benefits of project management practices and even came with PM certifications and experience themselves. Our consultants thus joined the PMO with full alignment from stakeholders and a vested interest in doing whatever it takes to realize a successful transformation for the Bank.

“As the Bank continues to grow, we are always looking for dynamic ways to leverage the strengths of our people and our partners to help us succeed. We believe that by working together, we can achieve more than we could on our own.

That’s why we’re excited about our partnership with MP, who has a proven track record of success in helping various organizations deliver projects. They have a deep understanding of Bank of Guam and they’re committed to helping us achieve our goals.

By engaging with MP, we’re confident that we can ensure effective project management and execution across our enterprise. This will allow our people to focus on what they do best: delivering outstanding service to our customers.

We look forward to the possibilities that this partnership brings, and we’re confident that MP will help us take Bank of Guam to the next level.”

Maria Eugenia H. Leon Guerrero, Executive Vice President / Chief Operating Officer at Bank of Guam

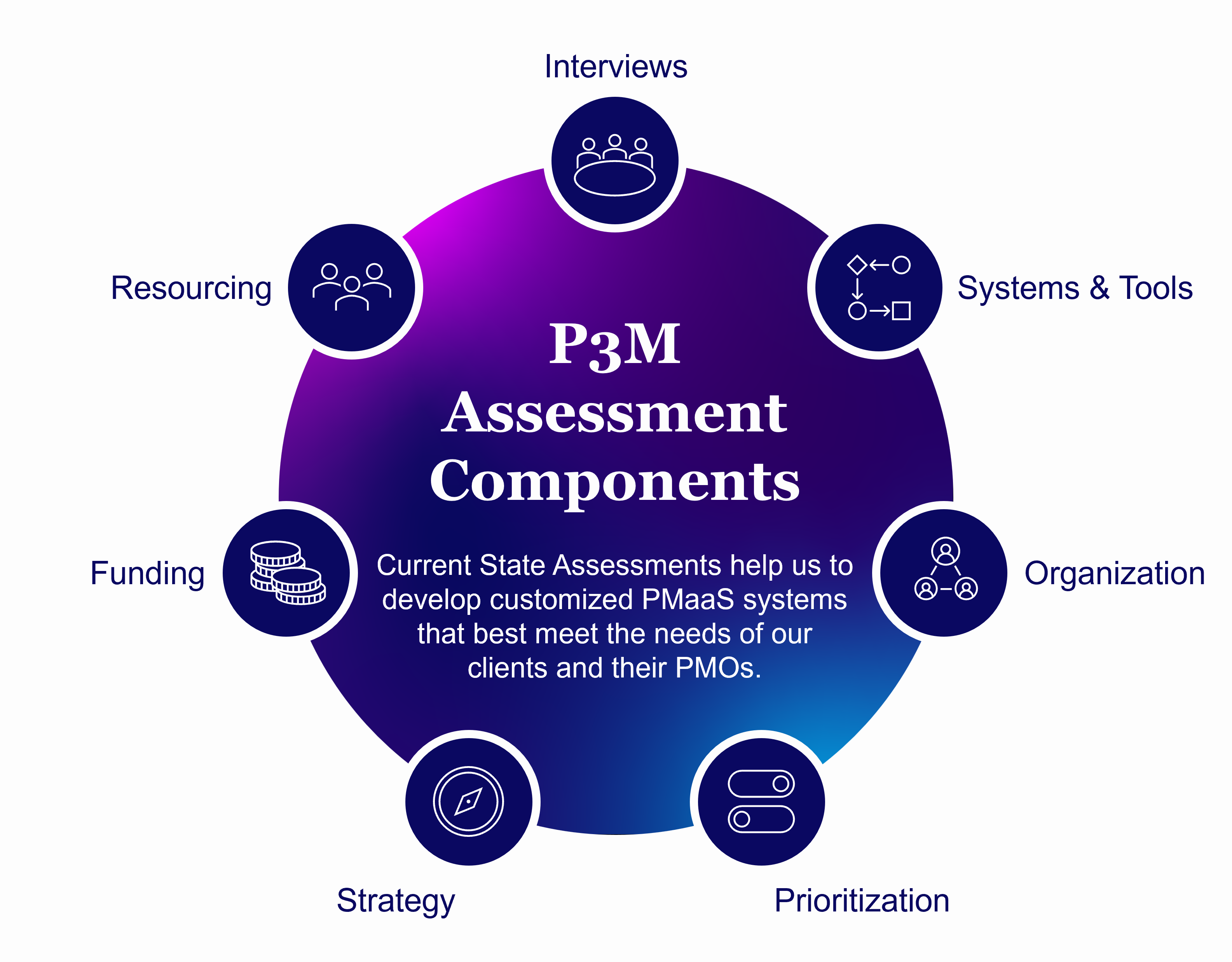

Our approach with Bank of Guam was to pair the implementation of PMaaS with a current state assessment to better understand their:

Ideally, we conduct the current state, or P3M, assessment ahead of the PMO transition so that it can be set up based on the insights and learnings right from the start. Other large consultancies may provide a standardized approach to delivery and will end up spending a lot of time reworking processes and the delivery roadmap as they learn more about the organizations they are supporting. They value speed to start over a customized solution.

We also validate the way projects are sized and prioritized during the assessment so that we can adjust our resource plan to ensure we have adequate capacity and appropriate skills/experience to deliver successfully. This is the approach we took with Bank of Guam.

After performing the initial assessment, we were able to develop both a short-term and mid-term plan to begin leading the PMO with an improvement roadmap and areas for optimization. It also allowed us to ensure the right governance and technologies were put in place to quickly add value, drive transparent communication about project status and overall performance of the project management function, and make collaboration and access to project details more convenient and efficient for project sponsors and other stakeholders.

Organizations often struggle to find the right balance between their company’s project management processes, with them often being too ridged or too light. They want to encourage employee participation and compliance by keeping things easy, but that may mean insufficient project analysis and definition.

Alternatively, asking non-project managers to initiate projects without guidance and expertise can cause huge gaps in procured service provider quality and a lack of value realization metrics. Yet another challenge is projects requested by department leaders may be working in silos, and they may be unaware of other solutions, technologies, and overlapping dependencies.

Bank of Guam was transparent about its specific challenges, so we could collaborate on a plan to address those items. Their top challenge was handling resource constraints and planning since many other non-PMO initiatives were running concurrently in addition to the PMO’s portfolio of projects. They lacked insight into the size, scale, and timing of those non-PMO initiatives which made it hard to determine the true organizational capacity at any given time and further complicated the decision about when to kick-off new PMO projects.

As of now, we have successfully transitioned Bank of Guam’s PMO from their previous service provider and are actively running the portfolio. We have set up the new PMO, provided key templates, and improved delivery processes.

We are working to iteratively implement identified improvements to optimize project initiation and planning. Our goal is to ensure any new projects approved for kick-off within the PMO are getting support from our consultants to better define project objectives and metrics and provide better insight into non-PMO initiative resource constraints.

We are excited to see the impact of these improvements as inherited projects close and new projects start off right. Having a holistic transformation strategy will ensure future projects and programs work together instead of against one another. We are so thankful to work with amazing client organizations like Bank of Guam, who allow us to truly partner to deliver value. Our alignment of values and strong respect and communication with one another makes working together both fun and impactful.

This article was written by Breanna Recker.

Loved what you just read?

Let's stay in touch.

No spam, only great things to read in our newsletter.

We combine our expertise with a fine knowledge of the industry to deliver high-value project management services.

MIGSO-PCUBED is part of the ALTEN group.

Find us around the world

Australia – Canada – France – Germany – Italy – Mexico – Portugal – Romania – South East Asia – Spain – Switzerland – United Kingdom – United States

© 2024 MIGSO-PCUBED. All rights reserved | Legal information | Privacy Policy | Cookie Settings | Intranet

Choose your language

Our website is not supported on this browser

The browser you are using (Internet Explorer) cannot display our content.

Please come back on a more recent browser to have the best experience possible