Our website is not supported on this browser

The browser you are using (Internet Explorer) cannot display our content.

Please come back on a more recent browser to have the best experience possible

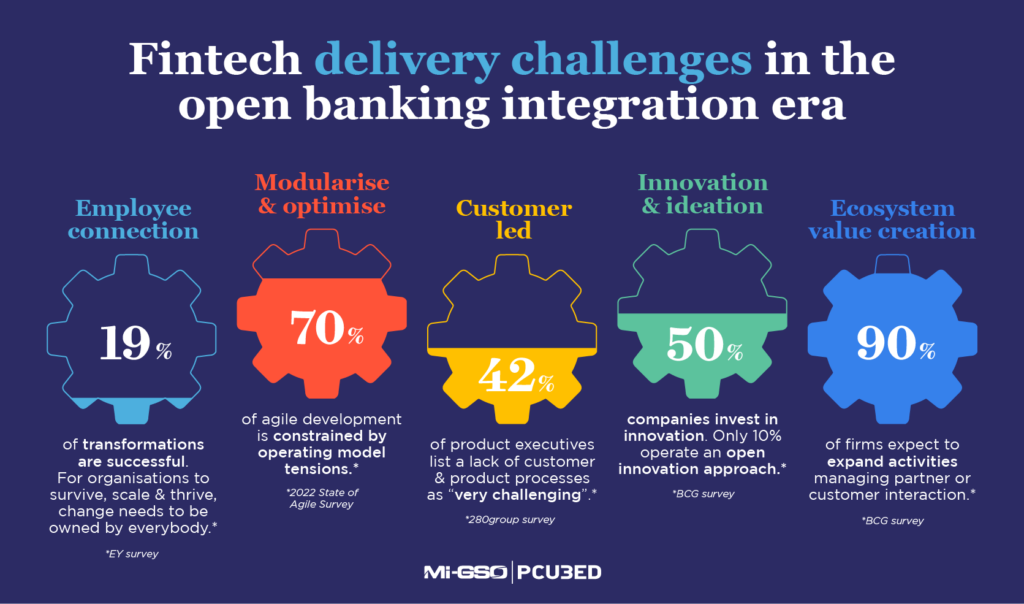

Our experience has led us to five strategic delivery questions that have to be answered to help scale up a Fintech business.

Over the next five years, Fintechs have a huge opportunity to grow and expand in what industry expert, Chris Skinner*, calls the Fintech Integration Era. This is a period when Fintech services get fully integrated into the financial system through Open Banking and open API’s.

Data will have to move easily between established Fintech organisations at a time when banks are resistant to being open, and Fintech’s lack the maturity to operate under the pressure of complex partnerships. Indeed, many Fintechs are only in early development collaboration with banks, rather than leveraging them more fully and using them as their know your customer and Regulatory “front doors.”

To succeed at scaling into this environment, Fintechs have to answer how they address five key strategic questions. These can be summarised as:

Here at MIGSO-PCUBED, our experience tells us Fintechs need to rapidly build new capabilities to answer these questions. We can help your business reach these capabilities to aspire to 10-fold growth, not just 10% EBIT

Combining these capabilities has the potential to deliver a 10 fold performance increase across an organisation.

* Chris Skinner, The Finanser CEO Doing Digital, Lessons from leaders

This article was written by John Sheffield – managing consultant, with over 40 years business and technology delivery experience, most recently with a C-level transformation role within a major blockchain engineering company

Loved what you just read?

Let's stay in touch.

No spam, only great things to read in our newsletter.

We combine our expertise with a fine knowledge of the industry to deliver high-value project management services.

MIGSO-PCUBED is part of the ALTEN group.

Find us around the world

Australia – Canada – France – Germany – Italy – Mexico – The Netherlands – Portugal – Romania – South East Asia – Spain – Switzerland – United Kingdom – United States

© 2024 MIGSO-PCUBED. All rights reserved | Legal information | Privacy Policy | Cookie Settings | Intranet

Perfect jobs also result from great environments : the team, its culture and energy.

So tell us more about you : who you are, your project, your ambitions,

and let’s find your next step together.

Dear candidates, please note that you will only be contacted via email from the following domain: migso-pcubed.com. Please remain vigilant and ensure that you interact exclusively with our official websites. The MIGSO-PCUBED Team

Choose your language

Our website is not supported on this browser

The browser you are using (Internet Explorer) cannot display our content.

Please come back on a more recent browser to have the best experience possible