Our website is not supported on this browser

The browser you are using (Internet Explorer) cannot display our content.

Please come back on a more recent browser to have the best experience possible

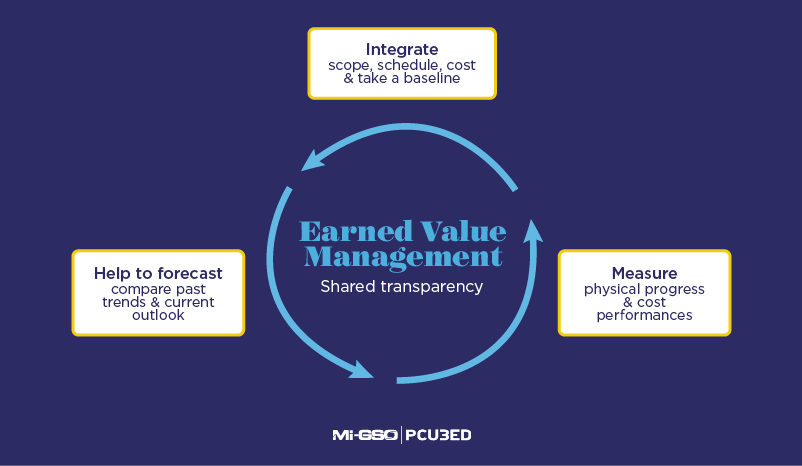

It is very important to understand the relationship between a project’s schedule and cost. If a project is behind schedule, do you deduce there is a problem? If this same project is underbudget, is the schedule delay still an issue? Earned Value Management (EVM) is a method that allows us to make this connection between a project’s schedule and cost as well as to know if the project is on the right path or not.

In this article, we will explain the concepts behind Earned Value Management and how to utilize them.

Earned Value Management links the two aspects of project management that constitute schedule and cost. This allows us to measure a project’s performance by defining the project’s status at a given moment and forecasting up to the project’s closing. It allows for robust project scheduling and captures the costs that help us to identify any variances. This creates an integrated view that facilitates action planning while having a forecast up to the end of the project.

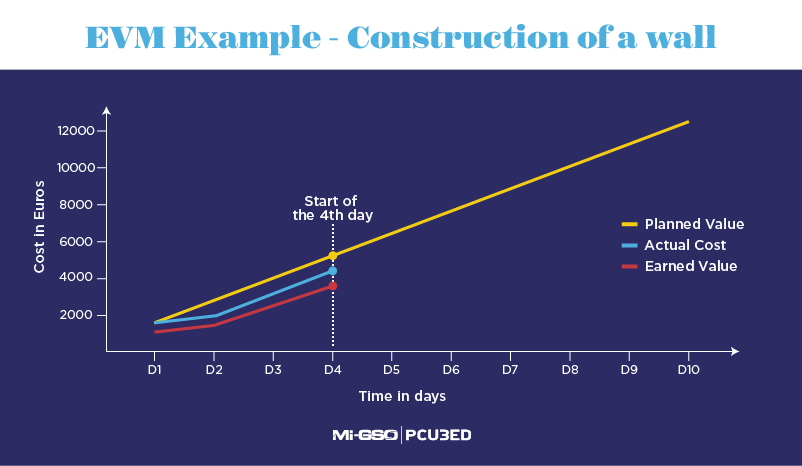

So, how do you calculate Earned Value, and how do you link the schedule to its cost? Let’s define three terms: Planned Value – PV, Actual Cost – AC and the famous Earned Value – EV.

First, let’s look at Planned Value (PV), which corresponds to our baseline. Therefore, it also corresponds to the Budgeted Cost of Work Scheduled (BCWS), or how much we have planned to spend for the scheduled activities.

Let’s take a simple example: we have a project to build a wall with 5 rows of 4 bricks, each one making the following assumptions: 1 brick costs $500, 1 resource costs $100 per day, and 2 bricks are installed each day. At the end of the fourth day the planned value (PV) is $4,400. That is (2 bricks x 4 days x $500) + (1 resource x 4 days x $100).

Next, let’s look at Actual Cost (AC). This corresponds to the Actual Cost of Work Performed (ACWP), or how much we have spent for the achieved activities.

Keeping our example of building a wall, let’s say in 4 days we have only placed 6 bricks. Also, let’s say 1 brick was broken, so we have used 7 bricks. The actual cost (AC) at the end of the 4th day is then $3,900. That is (7 bricks x $500) + (1 resource x 4 days x $100).

And here we are, the famous Earned Value (EV)! This corresponds to the Budgeted Cost of Work Performed (BCWP), or how much we should have spent for the achieved activities.

Let’s continue with our example and calculate the earned value of this project. As a reminder: 6 bricks have been installed on the wall in 4 days. However, it should have been done in 3 days with the initial assumption that we placed 2 bricks per day. At the end of these 4 days, the earned value (EV) is then $3,300. That is (6 bricks x $500) + (1 resource x 3 days x $100).

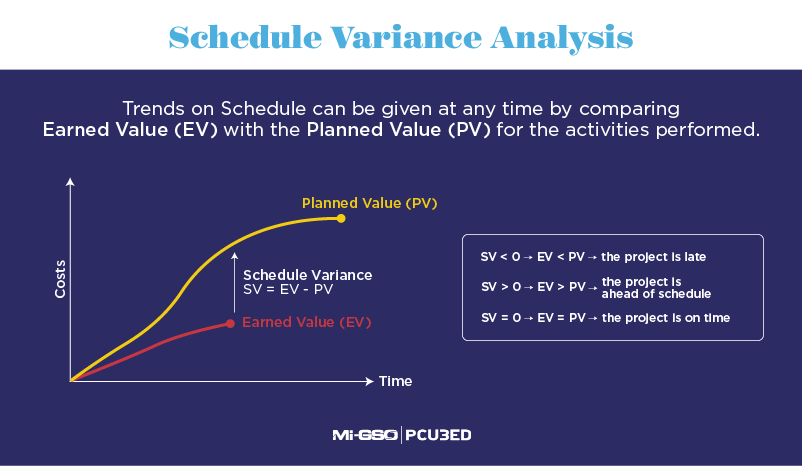

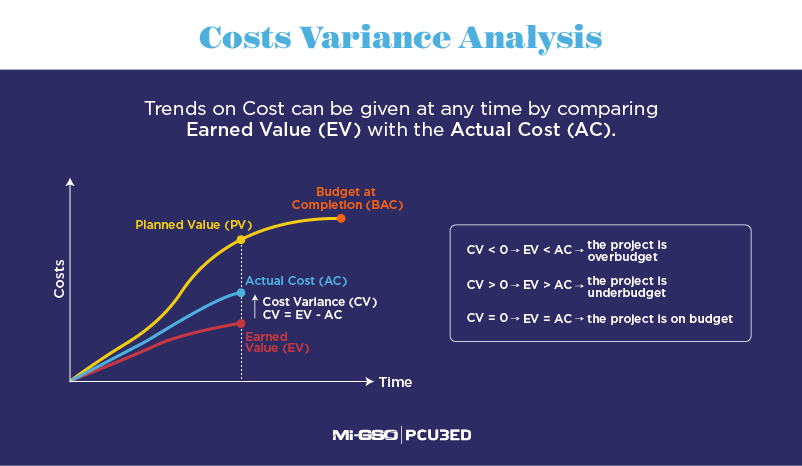

Once we have calculated the different values (PV, AC, and EV), it is time to analyse them in order to determine whether or not the project is behind schedule and/or overbudget. This is the objective of the variance analysis. The Schedule Variance (SV) allows us to measure the gap in the schedule while the Cost Variance (CV) allows us to measure gap in cost.

The Schedule Variance (SV) corresponds to the gap in schedule and is calculated by taking the difference between the earned value (EV) and the planned value (PV) so SV = EV – PV.

That gives us a sum that we can interpretate as follows:

The Cost Variance (CV) corresponds to the gap in cost and is calculated by taking the difference between the earned value (EV) and the actual cost (AC) so CV = EV – AC.

That gives a sum that we can interpretate as follows:

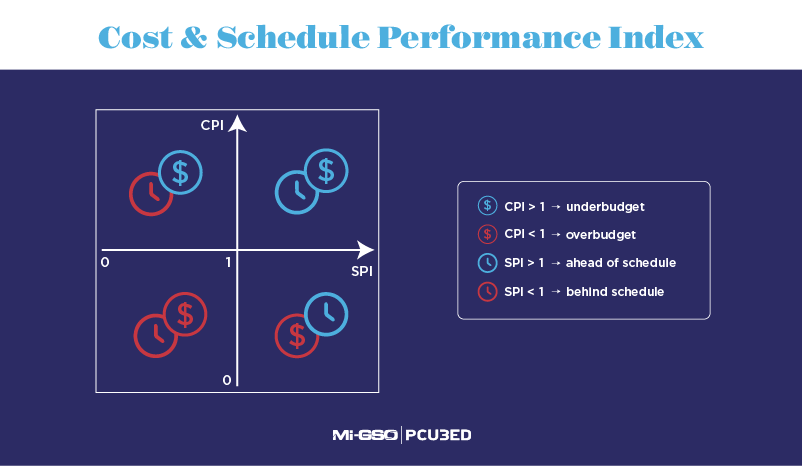

We have just talked about variance analysis (SV and CV), which allows us to measure gaps by doing a difference calculation. The performance indexes do the same type of analysis but using ratios.

The Schedule Performance Index (SPI) corresponds to the performance index for schedule and is calculated by taking the ratio between the earned value (EV) and the planned value (PV), which means SPI = EV/PV.

That gives us a percentage that we can interpretate as follows:

For example, an SPI equal to 0.8 tells us that there is a delay of 20% compared to the planned schedule.

The Cost Performance Index (CPI) corresponds to the performance index for cost and is calculated by taking the ratio of the earned value (EV) and the actual cost, which means CPI = EV/AC.

This gives us a percentage that we can interpretate as follows:

For example, a CPI equal to 1.2 tells us that the actual cost is 20% below the planned budget for the same work.

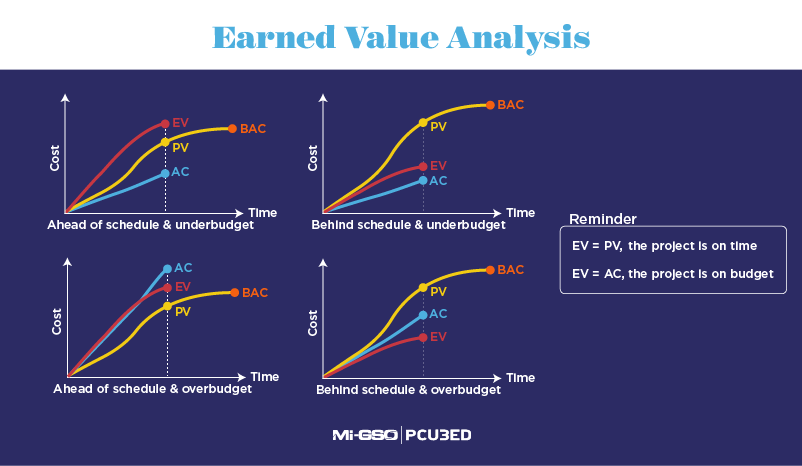

Analyzing schedule and cost separately do not provide a clear indication of the project’s desired trajectory. If we only look at the schedule, it is possible that delays may be the only apparent issue. A project that is late is an issue, but if the project is underbudget, this schedule delay in context could be considered less significant.

That’s why the Earned Value Management (EVM) approach is beneficial. It links both aspects of a project to see the project’s performance more accurately. To expand on this topic, you can read more in our articles about cost management and visit our job opportunities.

This article was written by Laetitia Muratet.

More on the same subject

Loved what you just read?

Let's stay in touch.

No spam, only great things to read in our newsletter.

We combine our expertise with a fine knowledge of the industry to deliver high-value project management services.

MIGSO-PCUBED is part of the ALTEN group.

Find us around the world

Australia – Canada – France – Germany – Italy – Mexico – Portugal – Romania – South East Asia – Spain – Switzerland – United Kingdom – United States

© 2024 MIGSO-PCUBED. All rights reserved | Legal information | Privacy Policy | Cookie Settings | Intranet

Choose your language

Our website is not supported on this browser

The browser you are using (Internet Explorer) cannot display our content.

Please come back on a more recent browser to have the best experience possible